// SIP

What are SIPs?

SIPs are the recommended investment avenue for young investors. You can invest small or big amounts at a frequency of your choice – weekly, monthly, quarterly, biannually or annually. You could start from as little as Rs. 100 and choose the date of payment. You can also set up mandates allowing the mutual fund to automatically deduct the amount from your bank account.

How do SIPs work?

Its like a recurring deposit in Mutual Fund Scheme. The amount debited from your bank account will be used to buy ‘units’ that are credited to your mutual fund account within days. Say you want to invest Rs. 1,000 every month in a particular fund – you can register a SIP that deducts the amount from your bank account every month on a pre-decided date.

The number of units allotted depends on the NAV of the mutual fund scheme on the date of deduction. The process continues for the chosen duration and frequency of your investment.

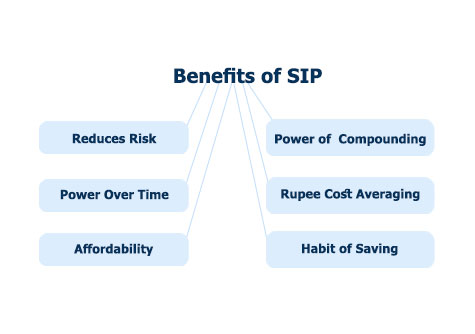

// Advantages of SIPs

Becoming a disciplined investor

For a new investor, SIP saves the trouble of finding suitable investment options yourself. The option of automated payments from your bank account also reduces the hassle of investing manually. SIPs are a great way to set a routine and learn investing discipline.

The power of compounding

Compounding is key to the idea of mutual funds – your returns are reinvested to generate even more returns. Thus, even smaller investments can grow and generate substantial returns in the long run. Try to start early and invest for a long time to gain the full benefit of compounding.

Rupee cost averaging

Rupee cost averaging is a major advantage of SIPs. It works by averaging out the costs at which you buy units of a mutual fund in the long run. It means if you invest regularly, you buy more units when the markets are low and fewer units when they are high. By spreading out investments this way over time, it reduces the average cost of your holding over the long term.